Investors looking to capitalize on a rising market often turn to index funds for stable returns. However, individual stocks can vary widely in performance, sometimes leading to disappointing outcomes. This has been the case for shareholders of Chow Tai Seng Jewellery Co., Ltd. (SZSE:002867), who have seen the company’s share price drop by 41% over the past three years. This decline is steeper than the broader market’s drop of 27% during the same period. Unfortunately, the past year has been particularly rough, with the share price plummeting by 32%. In just the last quarter, the stock has fallen another 35%, adding to the woes of investors.

Given the recent struggles, it’s worth taking a closer look at the company’s fundamentals to understand what might be driving these trends.

Warren Buffett, in his famous essay “The Superinvestors of Graham-and-Doddsville,” pointed out that stock prices don’t always reflect a company’s true value. By examining the relationship between earnings per share (EPS) and share price changes over time, we can gain insight into how investor sentiment toward a company has evolved.

Over the past three years, even as Chow Tai Seng Jewellery’s share price declined, the company managed to increase its EPS by 4.1% annually. This suggests that the drop in share price might not be due to poor business performance. Instead, it could indicate that the market had overly high expectations for EPS growth, leading to disappointment when those expectations weren’t met.

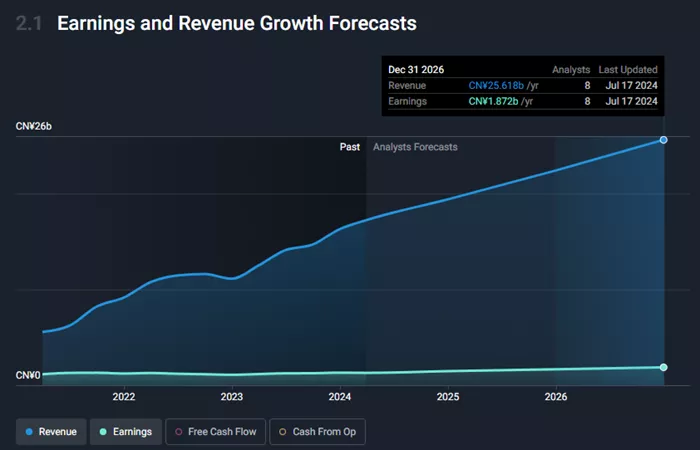

Despite the decline in share price, Chow Tai Seng Jewellery has managed to grow its revenue over the last three years. This revenue growth could signal potential opportunities for investors if the company continues on this trajectory. The market’s reaction, however, suggests that there might be other factors at play that are contributing to the stock’s weakness.

For investors considering buying or selling Chow Tai Seng Jewellery stock, it’s essential to look beyond just the share price and examine other financial metrics. A detailed analysis of the company’s balance sheet, for example, might provide further insights into its financial health.

Dividends and Total Shareholder Return

When evaluating a stock’s performance, it’s important to consider not just the share price return but also the total shareholder return (TSR). The TSR includes the value of dividends, any spin-offs, or discounted capital raisings, assuming that dividends are reinvested. For Chow Tai Seng Jewellery, the TSR over the last three years is -31%, which is slightly better than the share price return alone. This indicates that the company’s dividend payments have somewhat cushioned the blow for investors.

A Broader Perspective

Looking at the past year, Chow Tai Seng Jewellery shareholders are down 28%, including dividends. This is worse than the broader market’s 17% decline. Unfortunately, this poor performance adds to a longer trend of losses, with shareholders experiencing an average annual loss of 1.7% over the past five years. Long-term share price weakness can be a concerning sign, although contrarian investors might see potential for a turnaround if they believe the company’s fundamentals remain strong.

While market conditions certainly impact stock prices, it’s crucial to consider other factors that may be influencing the company’s performance. For those interested in Chow Tai Seng Jewellery, it’s advisable to look into potential warning signs within the company’s operations or financials.

For investors seeking other opportunities, it may be worth exploring a collection of growth stocks that could offer better prospects than Chow Tai Seng Jewellery.